Key Takeaways from the US Motor Retail Reporting Season

This week’s US motor retail reporting season provided valuable insights into the state of the automotive industry, dealer profitability, and evolving consumer behaviour. With earnings reports from major players such as Lithia Motors, Group 1 Automotive, Sonic Automotive, Penske Automotive, AutoNation, O’Reilly Automotive, and Asbury Automotive, we can piece together a clearer picture of the challenges and opportunities shaping the US sector in 2025.

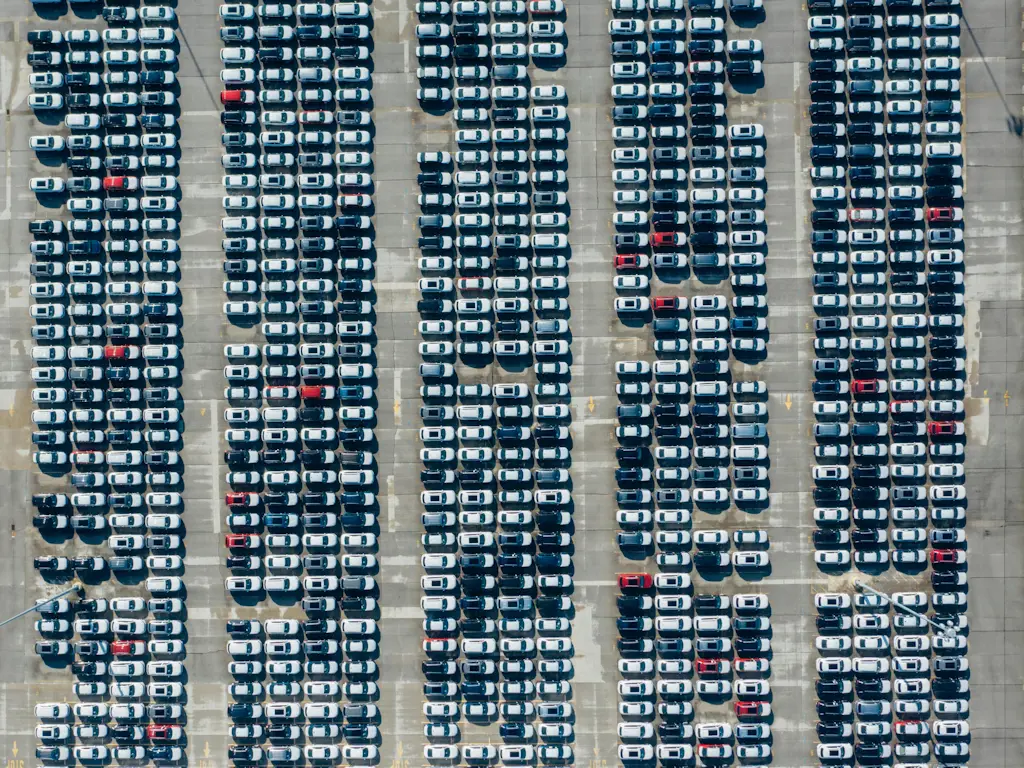

1. Resilience in New Vehicle Sales

Despite economic headwinds, the new vehicle market has remained surprisingly resilient, with new vehicle sales in the same store growing.

• Lithia Motors reported a 12% year-on-year (YoY) increase in new vehicle unit sales.

• Group 1 Automotive saw a 21% rise in new vehicle revenue.

• Penske Automotive achieved a 7% increase in same-store retail automotive service and parts revenue, corresponding to a 9% rise in gross profit.

The key factors supporting this growth include:

• Premium and luxury segment demand: Higher-margin models are leading the way.

• Stable pricing environment: While margins are softening, they remain above pre-pandemic levels.

• Inventory stabilisation: With the decrease in the supply of inventory over the days, dealerships are managing stock turnover more effectively.

This suggests that while consumers remain price-sensitive, demand for new vehicles is steady, particularly in premium and luxury categories.

2. Used Vehicle Market: Stability Despite Headwinds

The used car market continues to be challenging due to supply constraints and high interest rates, but there are signs of stabilisation.

• Lithia Motors reported a 6% increase in used vehicle unit profitability despite flat overall sales.

• Group 1 Automotive’s used vehicle retail sales grew 24% YoY, although wholesale values remained volatile.

• Sonic Automotive’s EchoPark division, which specialises in used vehicle sales, returned to positive EBITDA for the first time in three years.

One key trend is a shift towards more affordable vehicles, with sub-$20,000 price points outperforming the rest of the market. This reflects consumer demand for lower-cost mobility solutions amid higher financing costs.

3. After-Sales and Finance & Insurance (F&I) as Profit Drivers

One of the most significant takeaways from this reporting season is the continued profitability of after-sales services and finance & insurance (F&I).

• Lithia Motors’ F&I profitability increased sequentially by ~$100 per unit.

• Group 1 Automotive’s service revenue grew 9% YoY, reflecting strong customer retention.

• Sonic Automotive increased technician headcount by 335, boosting service revenues.

With higher repair and maintenance costs, many consumers opt to extend the life of their vehicles rather than replace them. Service centres are proving to be a critical hedge against cyclical downturns.

4. Digital & Omnichannel Strategies Driving Growth

Retailers continue to invest in digital transformation to enhance the customer experience.

• Sonic’s EchoPark omnichannel platform is driving customer retention.

• Group 1’s AcceleRide digital retailing tool has seen increased adoption.

The takeaway? Dealerships that embrace a hybrid online/in-store model are better positioned to capture market share, particularly in the competitive used vehicle segment.

5. Dealer Valuations: Why US Groups Trade at Higher Multiples Than UK Counterparts

One notable takeaway from the earnings season is the premium valuations of US dealer groups compared to their UK counterparts.

• US dealers typically have better scale, allowing them to spread costs more efficiently.

• Higher margins in new, used, and after-sales segments provide more stable earnings streams.

• More favourable franchise agreements in the US enable retailers to capture higher returns on capital, whereas UK retailers often face tighter manufacturer restrictions.

As an equity analyst covering these stocks, I saw that US automotive retailers have structurally better economics than UK dealers, which supports higher share price multiples and more substantial long-term investment cases. According to data from Sharepad, average prospective P/E ratios of 11-13x are slightly below historic mid-cycle levels in the US, which feels right for now.

6. Capital Allocation: Mergers, Acquisitions, and Share Buybacks

Strategic acquisitions and share repurchase remain a key focus for major players:

• Lithia Motors reduced its share count by 7% in 2024, returning capital to shareholders.

• Group 1 Automotive acquired 68 dealerships, adding $3.9 billion in expected annual revenue.

• Penske Automotive completed the acquisition of Porsche Centre Melbourne, expanding its premium brand portfolio.

• Asbury Automotive’s Q4 earnings showed substantial operational improvements, with net income per share increasing from $5.20 to $6.12.

The industry remains in consolidation mode, with the most prominent players leveraging scale advantages and capital discipline to drive growth.

Final Thoughts

The Q4 2024 results reaffirm the relative strength of the US motor retail industry, particularly in new vehicle sales, after-sales services, and digital retailing. While the used car market remains challenging, stabilisation is underway, and strategic investments in omnichannel platforms and service operations are proving wise moves.

As we move into 2025, inventory management, interest rate sensitivity, and consumer confidence will be key factors. The industry appears well-positioned for a resilient, albeit more normalised, growth trajectory.

Have a great week!