Navigating the Shifting Landscape of US VC Valuations: Insights from Carta's Q2 2024 Report

As the venture capital (VC) ecosystem evolves in 2024, the US valuation landscape remains dynamic, marked by challenges and opportunities. Carta’s recent Q2 2024 US VC Valuations Report sheds light on the critical market trends, providing valuable insights for investors, startups, and other stakeholders.

A Gradual Correction in Valuations

The report highlights a slow but ongoing correction in venture market valuations, reflecting the broader economic uncertainties that influence investment strategies. While the overall market remains under pressure from high interest rates and inflation, specific verticals, particularly Artificial Intelligence (AI) and Machine Learning (ML), are bucking the trend with significant valuation increases.

AI & ML have become the focal point of VC interest, capturing nearly 50% of the total deal value in the US market during Q2. Mega-deals primarily drive this surge, including CoreWeave and xAI’s substantial fundraising of $8.6 billion and $6 billion, respectively. The intense focus on AI is not just a matter of hype; instead, it reflects a belief in the transformative potential of these technologies, which has led many companies to pivot towards AI-centric business models to attract investment.

The Impact of Public Market Performance

Interestingly, the public market’s influence on VC valuations remains significant yet mixed. While the S&P 500’s most prominent companies have seen a robust performance, the broader index and newly listed tech firms have faced challenges. The uneven public market performance has created a dichotomy: while some sectors are flourishing, others are struggling to maintain their valuations, especially in the face of rising capital costs.

One notable point from Carta’s analysis is the challenge of interpreting median valuations without considering the broader market context. For instance, despite some stages seeing median valuations higher than those in 2021, the number of reported valuations has significantly decreased. This indicates that fewer companies successfully raise funds at higher valuations, often opting for alternative financing options such as convertible notes or debt to avoid down rounds.

The Divergence of High-Quality Companies

The report further reveals a growing divergence in the market, where high-quality companies are pulling away from the rest in terms of valuation growth. These firms, often characterised by their advanced stages, strong revenue growth, and substantial market potential, continue to attract premium valuations. For example, early-stage AI companies have experienced a staggering median Relative Velocity of Value Creation (RVVC) of 114.9% in 2024, far outpacing other sectors like fintech and SaaS.

However, this success is not universal. The report warns of an increasing prevalence of flat and down rounds, particularly among companies unable to maintain the high growth benchmarks set during the pandemic. Such rounds now represent a decade high in the venture market, underscoring investors' cautious stance prioritising quality over quantity.

Prolonged Timelines and Secondary Markets

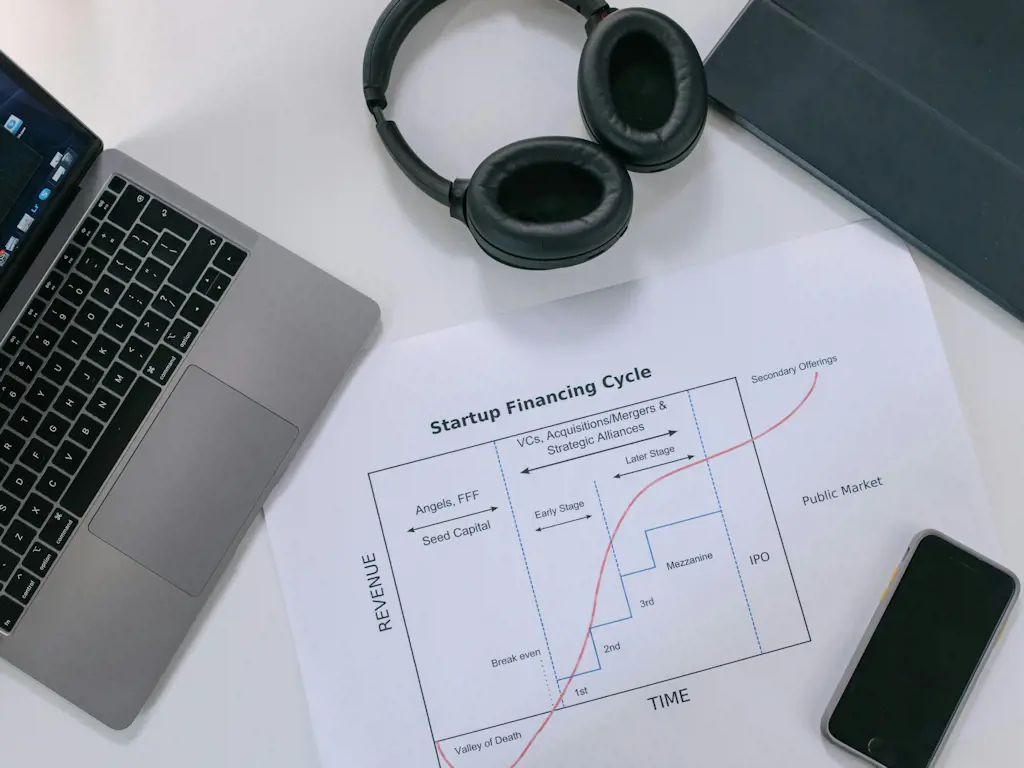

Another significant trend is lengthening fundraising timelines, particularly for late-stage companies. The median time between financing rounds has grown, with Series D+ companies now waiting over two years on average before raising additional capital. This extended timeline is partly a result of the challenging exit environment, where many startups prefer to stay private longer, waiting for more favourable conditions to go public.

In this environment, secondary markets have emerged as a critical source of liquidity, especially for top-performing startups. Secondary transactions allow investors to realise returns while providing companies an alternative to traditional fundraising. Carta’s report notes that while secondary discounts remain, they decrease, indicating a growing appetite for these transactions as a viable exit strategy.

A Parallel Look at the UK Market

While influenced by many of the same global forces as the US, the UK venture capital market exhibits its unique dynamics. Like in the US, UK investors have shown a strong interest in AI and deep-tech sectors, which continue to draw significant attention and funding. The UK’s strength in fintech remains a crucial pillar, with London maintaining its status as a global fintech hub.

However, the UK market is not without its challenges. The ongoing economic uncertainties, compounded by the post-Brexit environment, have led to cautious investor behaviour. Valuations in the UK have also seen a degree of correction, particularly in later-stage companies, as investors become more selective. This mirrors the trend in the US, where high-quality companies continue to attract investment while those unable to demonstrate strong growth or a clear path to profitability struggle to secure funding.

Another parallel between the UK and US markets is the increased reliance on secondary transactions as a source of liquidity. With IPO markets subdued, many UK startups are exploring secondary sales as an alternative, particularly as they seek to extend their runways in the face of a challenging exit environment.

The Road Ahead

Looking forward, the US and UK venture markets will continue to face headwinds as they adjust to a post-pandemic world of higher interest rates and cautious investment strategies. However, there are areas of optimism, particularly within AI and fintech, where innovation and investor enthusiasm are likely to keep valuations elevated.

The critical takeaway for stakeholders in the venture ecosystem is the importance of adaptability. Whether exploring alternative fundraising options, focusing on core strengths to attract premium valuations, or leveraging secondary markets for liquidity, startups and investors must remain agile in navigating this complex environment. As always, Carta’s insights provide a critical lens to view the evolving dynamics of the venture capital landscape on both sides of the Atlantic.

Have a great week!